The Denver metro area is experiencing a rise in apartment vacancies, with over 24,000 units

Learn More →

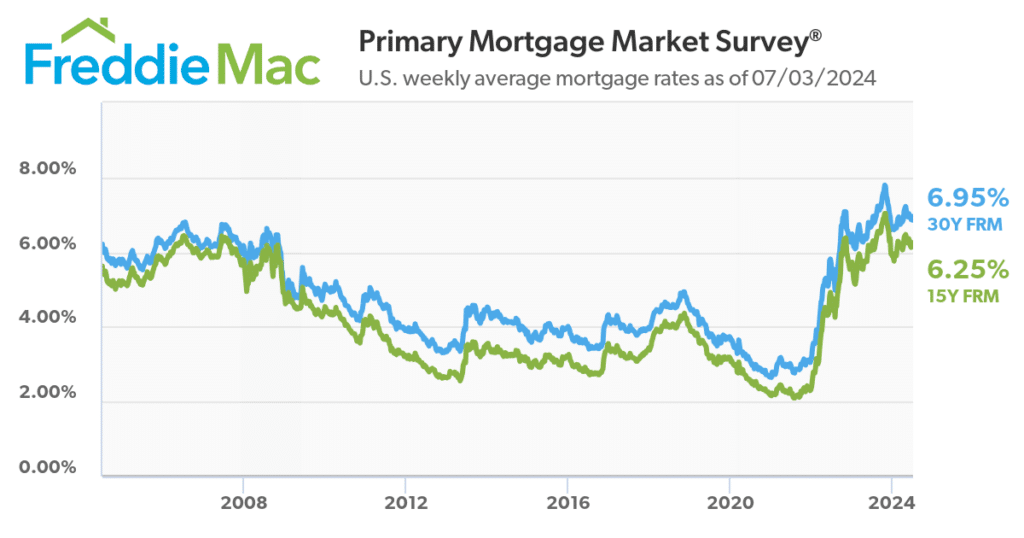

Home loan interest rates are expected to decline throughout the next two years, making homes more affordable. While they won’t be as low as the three to four percent range, housing is becoming more affordable, especially with owner-financed community projects such as those through Fruition.

The current home loan interest rate landscape remains volatile due to several factors, including inflation. As of the end of the first quarter, inflation again increased, though it was expected to decline.

According to Fannie Mae, mortgage rates were set to trend lower for the first month of the second quarter of 2024. However, because of several factors, including the increase in inflation at the end of the first quarter, the government agency now predicts the rates won’t drop as much as expected.[1] The current national rate, according to Bankrate, is 6.87 percent.[2] Fannie Mae expects rates to fall to 6.5 percent instead of 5.9 percent.

According to BuySide in the Wall Street Journal, economists expect home interest rates to drop slightly during 2024.[3] However, most people do not believe homes are affordable if interest rates are over 5 percent.

In January 2024, Fannie Mae expected the average interest rate on home loans to drop by the end of 2024. However, additional reports and an increase in inflation by the end of the quarter dashed those hopes.

Experts can’t agree on whether home mortgage interest rates will go up, down, or stay the same for the next week. A survey by Bankrate shows that 43 percent of these polled expect rates to rise, while 43 percent expect rates to decline.[4] Fourteen percent believe rates will stay the same. Forecasts predict that rates won’t drop below 6% until 2025.

The Fed policy meeting on March 20, 2024, did not cut short-term mortgage interest rates. Thus, home loan interest rates are staying at just above six percent. However, if you shop around, you could find interest rates closer to six percent if you have a good credit score.

If you are waiting for interest rates to drop before purchasing a house or new construction build, you’ll have some time to wait – potentially into 2025 or later – unless you find a developer or builder who offers a lower rate.

Because of the uptick in inflation and the better jobs report – and because economists don’t believe inflation will fall any time soon in 2024, current interest rates will most likely remain the norm for 2024 and into 2025.

Shopping around or checking with real estate developers or builders can get you into a home with slightly lower interest rates. Currently, economists expect that the Fed will cut interest rates at the June 12th meeting. However, that would mean increasing the maturing of Treasury securities faster, slowing the reduction in the Treasury balance sheet.[5]

Many factors contribute to the volatility of home loan interest rates. Inflation, jobs, the strength of the housing market, and federal policy changes all affect home interest rates. When these factors become volatile, mortgage interest rates can become volatile in response.

The more volatility in home mortgage interest rates, the less likely the Fed will lower them. Sometimes, just one factor in an up-and-down economy can cause havoc with interest rates.

While experts do not believe that mortgage rates will fall below six percent, no one can one hundred percent predict what the economy will do. Case in point: The Fed expected inflation to decrease in the first quarter of 2024. Instead, during the last part of the third quarter, inflation increased, which caused home mortgage interest rates to tick up.[6]

In early February, some lenders were showing rates just under six percent. By the end of March, those lenders who offered lower rates increased their rates. Even a half-percent increase could put a home out of reach for some people. At the same time, a half-percent drop for someone with stellar credit could make the dream of home ownership a reality.

While today’s mortgage rates seem high, they are lower than in the 1970s and 1980s. Then, mortgage rates peaked at over eighteen percent. However, people are used to seeing mortgage rates under five percent – and commonly, those with excellent credit could get a rate under three percent.

What you consider an affordable mortgage rate depends on several factors, notably your financial situation and credit score. When you compare mortgage rates for the last thirty years, the median rate is 7.4 percent.

When home prices and interest rates rise simultaneously, a six-percent home loan interest rate can seem unaffordable. However, six percent is better than seven or eight percent. While one percent doesn’t seem like much, it can make a significant difference, especially for higher-pricedhomes. A six-percent rate can save you over $263 compared to a seven-percent rate. It saves over $530, going from six percent to eight percent.

The cycle of increasing home prices and interest rates can mean a stagnant market. While home prices are high, sellers hope to make a bundle. However, with the higher interest rates, people can’t afford the home they want – or, in many cases, a home at all.

When home sales drop off because of affordability, homeowners stop trying to sell. If mortgage rates come down, even with the higher home prices, more people could afford a home, and the market would start moving again.

The record-low housing stock and high interest rates expected to continue for 2024 can leave the housing market in a lurch. People locked into low interest rates are reluctant to sell, as their interest rate would be significantly higher.

People in the market face unaffordability because of the combined increase in home values and higher interest rates. Because both sides of the housing market are at a standstill, home sales will likely remain low.

However, buyers can look into new home construction by builders who are also developers. They may find lower interest rates and better pricing for brand-new homes. For the market to start recovering, the home inventory needs to go up significantly. New home builders such as Fruition can contribute to the housing inventory while functioning as builders and developers.

Home price growth slowed in November and December of 2023 but has increased in some markets. However, according to Forbes, the Chief Economist at First American Financial Corporation, Mark Fleming, predicted that while growth rates won’t drop, he anticipates a “flat stretch ahead.” Forbes also stated that experts anticipate 2024 will see a slower home price growth than the past few years.

Fleming thinks the 2024 market will be “just right” compared to the hot market of 2020-2021 and the slow market of 2023. If prices drop and interest rates decrease, homes will become more affordable. Even if the market remains where it is and interest rates fall, people will find homes more affordable.[7]

Many factors can affect interest rates, including:

The Denver metro area is experiencing a rise in apartment vacancies, with over 24,000 units

Learn More →The 2024 edition of the Demographia International Housing Affordability report highlights significant challenges in housing

Learn More →From the earliest days of European settlement, Latinos have played a crucial role in the

Learn More →Unlock the mystery behind why securing a roof over your head has become an arduous

Learn More →to save your favourite homes and more

Log in with emailDon't have an account? Sign up

Enter your email address and we will send you a link to change your password.

to save your favourite homes and more

Sign up with emailAlready have an account? Log in

Manage your listings, profile and more

Sign up with emailAlready have an account? Log in