The U.S. Housing Market and Factors Towards Home Affordability

Inflation, wage growth, interest rates, and government initiatives can all impact whether or not you can afford a home. General trends, recent statistics, and future predictions help homebuyers examine whether the real estate housing market is within reach. The more information you’re armed with, the easier it is to navigate the road to homeownership.

Affordability in the Real Estate Housing Market

Housing affordability has become a significant concern for many Americans as real estate prices soar. Despite the general recommendation to spend no more than a third of your take-home salary on housing, fewer people can comply with this advice every year.

The more people are edged out of the market, the more likely homes will be sold to investors, opening the doors to potential housing monopolies and inflated rents. Measures to combat these trends, including private banks and government initiatives, have yet to go far enough to level out the numbers. That’s why it’s essential for everyone to both learn and keep up with the ever-changing landscape of the housing market.

Factors Influencing Home Affordability

- Income trends: Wages need to keep pace with the increases in housing to level the market.

- Interest Rates: The higher the interest, the more money the owner pays over time. From individual credit scores to federal rate caps, these in-flux rates play a crucial role in whether people can purchase a home.

- Supply: The more popular the area, the harder it will be for people to purchase even the most modest properties.

- Inflation: When the prices of goods and services rise across the board, the imbalance between wages and the cost of living can affect a person’s ability to pay home expenses.

- Policies: Every property is subject to local, state, and federal regulations. These extra costs, from HOA fees to property taxes, can price people out of a home.

Homeowners should know that the housing market can be challenging to track because conditions can change quickly. It’s essential to monitor all factors to have the best chance of pivoting when the time comes.

Trends in Salaries and Inflation

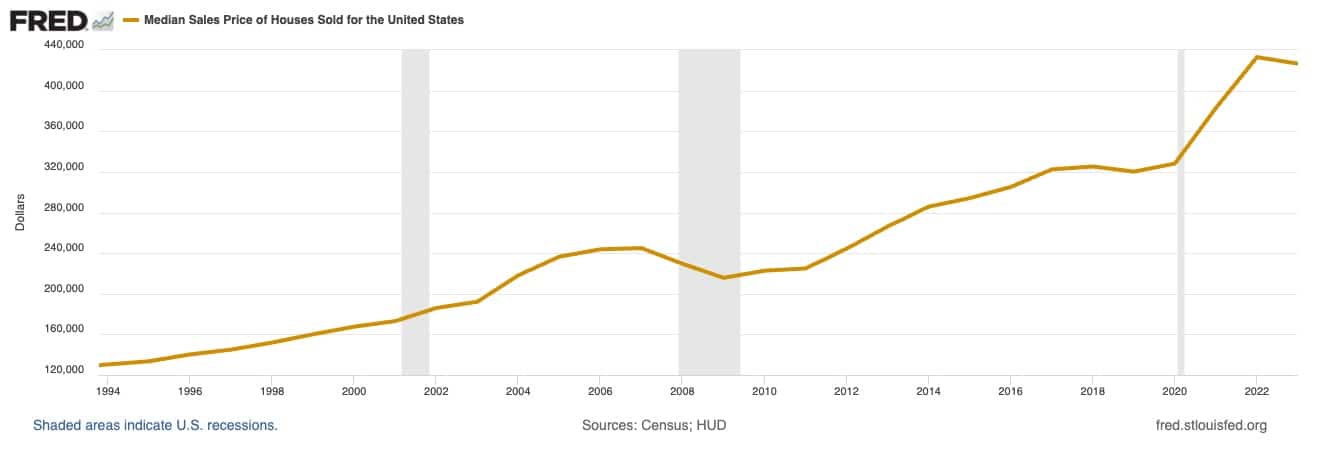

From 2010 – 2022, the median home sale price increased by around seventy-five percent, while the average household income increased by just over fifty percent.[1] Many debates have been held about the underlying causes of wage stagnation, including the death of unions, the rise in offshore employment, and the general priority of putting shareholder needs ahead of employee needs. These events have also shifted worker priorities, as people are far less likely to stay with the same employer for most of their careers.

When adjusted for inflation, wages have yet to undergo the necessary improvements for the average person to afford a home without significant help or extreme sacrifice. In the summer of 2022, inflation hit a forty-year high at 9.1%. Wage growth during that same period reached 6.7%, effectively reducing the spending power for most Americans. Unfortunately, these recent trends align with past events. Despite a few outliers, most positions aren’t paying enough for people to realize their dream of homeownership.

In terms of the average housing expense, the national rates for individuals and families are somewhat on par with the recommendations at thirty-four percent of their total budget. However, in certain parts of the country, such as California, the average costs are above forty-two percent.[3]

Housing Market Dynamics

The real estate market has been shifting recently for several reasons:

- Mortgage rates: During the pandemic, mortgage rates hit historic lows, making it easier for homeowners to pay the principal on their loans and lowering the barrier to entry into the market. Since then, mortgage rates have climbed, slowing demand and shifting control away from sellers.

- Inventory levels: More housing supply has been coming onto the market recently, possibly bringing prices down shortly.

- Regional variance: Certain areas are more susceptible to changing mortgage rates, inflation, and wage stagnation. Buyers may see rising home appreciation in neighborhoods with high demand despite economic uncertainty.

Market dynamics are essential for home affordability for the average buyer, though circumstances depend highly on the individual neighborhood. Rising inventory in low-demand areas can give buyers a strong bargaining chip.

However, homebuyers aren’t just competing against other homebuyers in the hottest cities. Numerous factors influence the housing market dynamics, from foreign conglomerates to inside investors.[2] To understand the US housing market, first-time home buyers must know their biggest obstacles and formulate ways to get ahead.

Impacts on Home Affordability

Home affordability is primarily tied to average US wages, the cost of living, and the general strength of the economy. While wages and inflation vary yearly, the general trend is that salaries haven’t kept up with average expenses.

When workers cannot predict their monthly expenses relative to their income, it can quickly push homeownership down their list of priorities. If workers are nervous about their job security due to anything from economic tailwinds to robotic technology, it can further reduce their confidence in scraping a down payment together. They may also want to avoid homeownership if they think they must move to get a better job. The more a family feels the pinch of inflation, the harder it will be to save up a down payment.

There are also incidental costs that homeowners need to account for. Those who can’t put down at least twenty percent of the home’s purchase price are typically subject to the additional costs of Private Mortgage Insurance (PMI) until they can reach twenty percent equity.

Government Policies and Interventions

Federal, state, and local governments create programs to help people bridge the (sometimes vast) gulf so they can afford a place of their own. Notable national programs include:

- FHA loans: FHA loans require homebuyers to put down just 3.5% on the property, making homeownership more accessible for people on a budget. Plus, people with credit scores in the 600s are more likely to be approved.

- USDA loans: The rules for these loans run the gamut but generally make the home-buying process easier for homes in certain areas. The boundaries for these homes change regularly but typically refer to those in more rural areas. Sometimes, interest rates can be as low as one percent with no down payment required.

- LIHTC: The Low Income Housing Tax Credit program offers private companies an incentive to build affordable housing by lowering the company’s federal taxes. These credits are received over ten years and require the housing to remain affordable for at least thirty years. While this program applies more to renters than buyers, it applies to both.

It’s essential for home buyers to look into all potential programs available in their area. For instance, veterans can apply for VA loans, and some buyers may receive additional assistance based on their profession (e.g., teacher, paramedic, etc.). Opportunities vary based on the location of the property and the time of the application.

Effectiveness of Housing Programs

These policies’ effectiveness truly depends on the individual at the heart of the equation. However, it’s worth noting that many people still do not find homeownership achievable even with these programs available. This is usually due to the number of trade-offs involved with these programs.

For instance, a family of four may be able to afford the down payment of a home in a rural area. Still, it would require them to move to an area with few job opportunities. An FHA loan with a 3.5% down payment may be more affordable, but it comes with the additional expense of private mortgage insurance (PMI). PMI increases the expense of the loan over time, which can end up crippling homeowners financially.

Future Outlook

While it’s difficult to make housing market predictions, the consensus is that home prices will likely stagnate soon, even though overall affordability is unlikely to change shortly. In other words, because wages and inflation aren’t going to change drastically, stagnating prices aren’t enough to attract more buyers.

Given the economic uncertainties and the general demand for companies to keep prices low and stocks high, wage growth is not expected to skyrocket in the near future. Instead, the market may see an even more significant rise in alternative housing, including a higher demand for micro-units or co-living environments, as people shift their expectations to account for their economic needs. Policyholders, stakeholders, and prospective homebuyers may need to be mindful of bigger changes to neighborhood infrastructure based on the future outlook.

Collaborative Efforts and Innovative Solutions

Today’s housing crisis in America can make buying a house feel as impossible to many buyers as it did back in 2008. Income trends, inflation, and interest rates are the cornerstones of the housing market. The average buyer is disadvantaged if they’re out of proportion. Their wages may barely cover the rent, let alone the extra expenses of a mortgage and homeownership.

Given these trends have been mainly holding for the past two decades, getting out of this situation will mean more than a few adjustments here and there. Without policymakers, stakeholders, and homebuyers working together, it is unlikely to see significant changes. It may mean a more extensive overhaul to implement solutions that can account for everything from social dynamics to corporate greed.

Share This Article:

Frequently Asked Questions

Why are houses so expensive?

Is the housing market going to crash?

What is the average income needed to buy a house?

When should I buy a home?

Subscribe to our email newsletter!

Related Posts

Population growth could stop and metro Denver would still have a housing shortfall

The Denver metro area is experiencing a rise in apartment vacancies, with over 24,000 units

Learn More →2024 Demographia Report Reveals Stark Housing Affordability Challenges

The 2024 edition of the Demographia International Housing Affordability report highlights significant challenges in housing

Learn More →El Futuro es Latino

From the earliest days of European settlement, Latinos have played a crucial role in the

Learn More →Feudal Future Podcast: Addressing the Housing Affordability Crisis and Protecting the Middle Class Dream

Unlock the mystery behind why securing a roof over your head has become an arduous

Learn More →